PYTXWI- Import Tax Withholding Tables

PowerSchool provides tax tables as a courtesy to assist districts; however, each district remains fully responsible for the accuracy of its own data, including tax tables and tax calculations. We strongly recommend that you verify the accuracy of the tax tables in BusinessPlus by spot-checking a sample of employee records and reviewing the relevant common codes listed below. Compare these against the most current tax information available to your district.

If you identify any discrepancies, please update your system accordingly and notify PowerSchool by submitting a support ticket.

The Import Tax Withholding Tables (PYTXWI) utility reads a CSV file in a predefined format to import tax withholding tables for federal, state, or levy taxes. This utility can be run in report-only mode (trial run), or configured to report only entries that have changed. When not run in report-only mode, PYTXWI will update the appropriate PYTX common codes.

The latest tax tables are available on PowerSource at:

https://support.powerschool.com

Navigate to: Support > Downloads > BusinessPlus > Tax Table for the most current tables information.

Import Tax Withholding Tables:

Tax Year: Enter the tax year.

Two Character State Code (or FE for Federal, LT for IRS Tax Levy): Enter the two-character state code, for example, AZ imports Arizona tax withholding tables. Alternatively, enter FE for federal tax tables or LT for IRS Tax Levy tables.

Please enter File with the Tax Withholding Tables: Enter the name of the import CSV file. Alternatively, click Location or Other to locate the file.

Is this a Trial Run [Report Only]?: Select this option to run the utility as a report. When not run in report-only mode, PYTXWI updates the appropriate PYTX common codes.

Show only entries that have changed?: Select this option to report only entries that have changed.

When not run in trial mode, the utility deletes all common code entries for category PYTX where ledger equals @@ for code values where the first two characters are equal to the entered state code (or FE, LT) and the third and fourth digits are the last two digits of the entered tax year.

For example, when importing Arizona tax withholding tables for tax year 2025, the SQL delete statement looks like this:

delete from cd_codes_mstr

where cd_category = 'PYTX' and cd_gr = '@@' and cd_code like 'AZ25%'

The process then reads through the CSV file and processes entries where:

Column one is PYTX

Column three is @@

The first four characters of column two are equal to ssyy, where ss = entered state code and yy = last two digits of the entered tax year.

When not in trial mode, the selected entries are used to create the PYTX common codes.

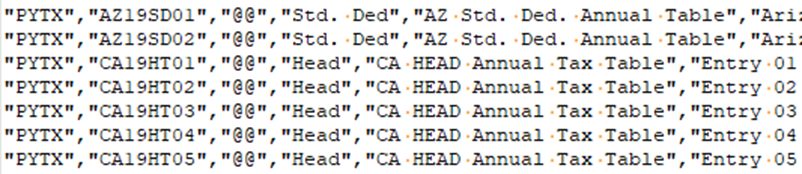

The following screenshot shows a sample CSV file. Using the example of Arizona (“AZ”) and tax year 2019, the import would only process the first two rows and all other rows would be skipped. If you select ** as the state code, the process will upload all tax tables in the file.

Import Reporting

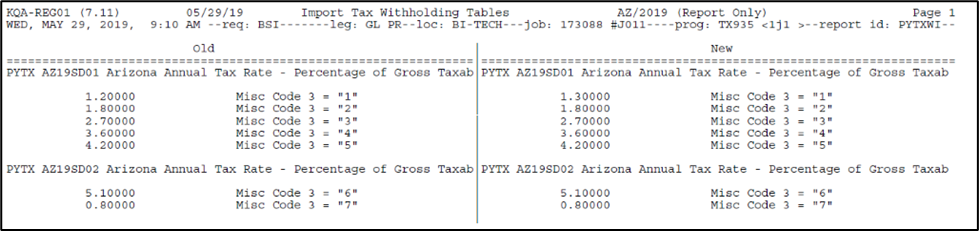

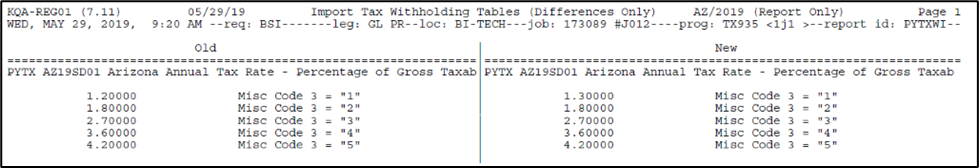

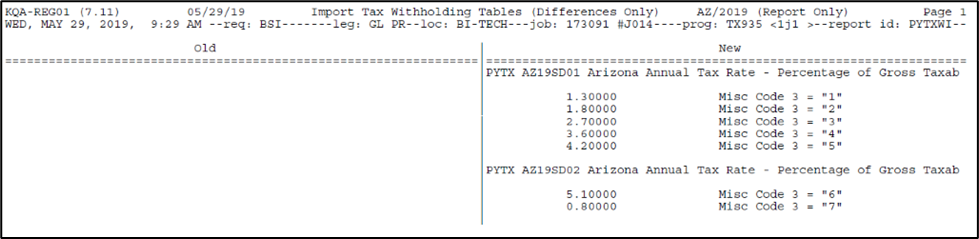

The report that is produced from the import shows the old entries along with the new entries. If the option to “Show only entries that have changed?” was selected, it will only show common codes that are different in the database between what is in the file.

In an example, Arizona only has two PYTX common codes. Only one has changed: numeric value number one was changed from 1.2 to 1.3.

When “Show only entries that have changed?” is not selected, it will show all entries in the import file.

When “Show only entries that have changed?” is selected, it will show only entries in the import file that differ from the existing common code entries.

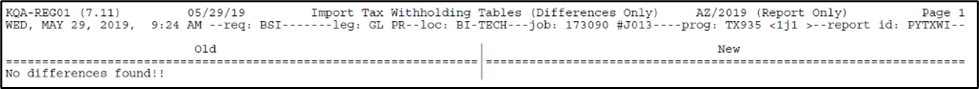

If no differences are found, it will show the following:

If there are no existing entries for that state and tax year, the report will look like this:

CSV File Format

Column Number | Column Letter (MS Excel) | cd_codes_mstr Item Name | Description |

|---|---|---|---|

1 | A | cd_category | Code Category |

2 | B | cd_code | Code Value |

3 | C | cd_gr | Ledger |

4 | D | cd_descs | Short Description |

5 | E | cd_descm | Medium Description |

6 | F | cd_descl | Long Description |

7 | G | cd_assoc_val01 | Associated Numeric Value 1 |

8 | H | cd_assoc_code01 | Associated Code 1 |

9 | I | cd_assoc_desc01 | Associated Description 1 |

10 | J | cd_assoc_val02 | Associated Numeric Value 2 |

11 | K | cd_assoc_code02 | Associated Code 2 |

12 | L | cd_assoc_desc02 | Associated Description 2 |

13 | M | cd_assoc_val03 | Associated Numeric Value 3 |

14 | N | cd_assoc_code03 | Associated Code 3 |

15 | O | cd_assoc_desc03 | Associated Description 3 |

16 | P | cd_assoc_val04 | Associated Numeric Value 4 |

17 | Q | cd_assoc_code04 | Associated Code 4 |

18 | R | cd_assoc_desc04 | Associated Description 4 |

19 | S | cd_assoc_val05 | Associated Numeric Value 5 |

20 | T | cd_assoc_code05 | Associated Code 5 |

21 | U | cd_assoc_desc05 | Associated Description 5 |