PYFG - PY660C

PY Check/EFT CheckWriter (Required)

PYFG/PY660C is the only required common code for clients using a py660xxx style Payroll Check and EFT writer program (xxx = client specific assigned code). DO NOT use any of these settings without understanding their function from the descriptions below. Many are not applicable to standard setups. Code 1 is the only field that is an absolutely required field, and most likely the long description (MICR).

Code Category: PYFG

Code Value: PY660C

Short Description: This field is used to turn on debug options. There are currently three debug options: DEBUG, DEBUG2, and CS-DEBUG.

"DEBUG" shows all the internal tables at four different progressions: 1.) after XTD is loaded, 2.) after history is loaded, 3.) after timecard info is loaded, and 4.) after it has all been sorted. It must be used with the trial payroll mask (PYTPDP), and is helpful in tracing issues in pay statement results…especially statements that are not getting printed but should be: "DEBUG2" shows a map of the logic as it moves from one routine to the next… mainly for programmer use. "CS-DEBUG" shows progression of the client specific final table manipulation before the print process. It is a programmer tool.

Medium Description: "EO ENABLED" is the standard setting for clients using Employee Online. "EO DISABLED" is an option to prevent the writing of pay stub information to the hr_eostub table. It is useful for new implementations that plan to add Employee Online features at a later date. It is also an emergency measure if a client exceeds data base limits because of the size of the hr_eostub table, but still needs to get a payroll run.

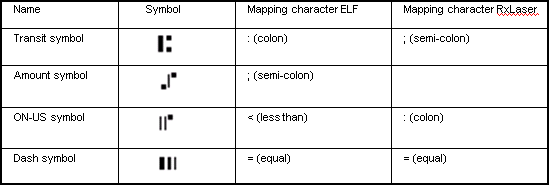

Long Description: Set this to the MICR encoding for the paychecks if the Payroll check writer process is to print the MICR line on the bottom of the check. MICR printing only works in conjunction with the use of ELF or RxLaser forms. The MICR line of the check is divided into three sections. The first section consists of the check number bounded on both sides by the ON-US symbol. The Payroll check writer automatically handles this section. The second section contains the bank's transit-routing number and the number of the account that the check is drawn on. The transit number is bounded by Transit symbols and the ON_US symbol follows the account number. The third optional section contains the check amount bounded by the Amount symbol and filled with "$" where the actual amount will print. The second and third sections are printed using the text contained in the long description. Use the table below to print the special characters.

Associated Numeric Values

1: Reserved for future use.

2-3: These values control fine adjustments in the alignment of the data printed on the form versus the pre-printed form layout. These values are pertinent only if pre-printed forms are used and serve to move all rows / columns up / down / left / right the specified amounts. (If ELF forms are used, these values are usually not needed.) These values are primarily used to account for positioning differences from printer to printer. For example, if pre-printed forms are in use and a different forms printer than normal is specified, these values may need to be modified to account for alignment differences between the old and new printer.

Value 2 will offset all row positions and value 3 will offset all column positions. Plus and minus values are acceptable. The row offset is in terms of six lines per vertical inch, e.g., a value of -1.00000 will move all rows up 1 / 6." The column offset is in terms of 12 characters per horizontal inch, e.g., a value of 1.00000 will move all columns right 1 / 12." Fractional values are acceptable.

4-5: These values control fine adjustments to the location of the MICR line print. Associated Numeric Value 4 controls Vertical movement: plus value shifts MICR downward, and negative value shifts MICR upward. Associated Numeric Value 5 controls Horizontal movement: plus value shifts MICR to the right, and negative value shifts MICR to the left. Both values can be either positive or negative numbers in decimal equivalent inches. For example, the decimal equivalent of 1/8" = 0.12500; 1/16" = 0.0625. These increments can vary. They do not have to be in 1/16" increments, but is recommended. Your bank can check the MICR print positioning or you may be able to talk them into giving you one of the clear plastic overlays they use to check the MICR positioning so you can check it yourself. Because different printers print in different locations for a specified row and column, your delivered Payroll check writer may print the MICR line in a less than desirable position. With this fine adjustment in the common code, you can adjust the MICR positioning when you first start using your Payroll check writer or when you change printers.

Associated Codes

1: ** This is a required field. Set this to the name of your client specific check/EFT writer program (without the ".cbl" extension for UNIX sites). Depending on your environment, look in either the ifas/bsi/source directory or ifas/app/custom/cob directory for your client specific py660 program. Example: If the py660 program in your directory was py660you.cbl, this field would need to show "PY660YOU," where the screen shot above shows "PY660XXX."

2: This value can control how checks / EFTs are sorted. The default sort is employee name within check distribution code (name within Education Code 5 if you are looking at PYUPEM). That is, if this field is left blank and your custom check / EFT writer does not explicitly specify a sort sequence, the sort will be by employee name within check distribution code. Supplying a value in this Associated Code 2 will override the default sort. Bear in mind that your custom check / EFT writer can override the value you put in this field. For example, suppose you wanted to change the sort to name within supervisor. To do this, you would set the value of this field to NS. But, if your custom check / EFT writer specifically sets the sort to something other than name within supervisor, the checks / EFTs will be sorted as per your custom check / EFT writer specification.Recognized values for this field are:

ID - ID Only

IO - ID Within Org Key

IS - ID Within Supervisor

NM - Name Only

ND - Name Within Department (PYUPEM Sel. Code 1)

NO - Name Within Org Key

NS - Name Within Supervisor

S2 - Name Within Selection Code 2 (PYUPEM Sel. Code 2)

E5 - Name Within Check Distribution Code (Education Code 5)

SE - Name Within Check Distribution Code Within Department (Educ. Cd. 5 and Sel. Code 1)

SG – Name Within Org Key Within Department (Sel. Code 1)

EG – Name Within Org Key Within Check Distribution Code (Educ. Cd. 5)Standard default sort direction is ascending order. It can be changed to descending order by placing an upper case "D" in the 12th position (right most) of code 2.

3: When this field is blank, employees with calculated history having a check note of "WP" and zero net pay will be ignored by the check/EFT writers.

When Associated Code 3 is set to "PRINTZERONET," zero net checks will print on check form stock. When this field is set to "ZEROCHKASEFT," zero net checks will be treated as if they are EFTs, and will print on EFT form stock. Important note: Associated Code 4 must be set to "ALLZERONET" when either of these two latter options is used.

4: When this field is blank, employees with calculated history having a check note of "WP" and zero net pay will be ignored by the check/EFT writers. When Associated Code 4 is set to "ALLZERONET," the zero net histories will be distributed, check note changed to "DP," and if Associated Code 3 is blank, they will be given a check number of 99999999.

5: This field should be set to "NO TABSTOPS" for most clients. Only clients that have multiple entities, and maintain a unique "TABSTOPS" file in the data directory for each data base should leave this field blank.

Associated Descriptions

1: Normally the check / EFT writer obtains the MICR account number from the long description of this common code, and this field is blank. If it is desired to get the MICR account number from the CKID / xx common codes (so that different check stock drawn on different banks can be processed), set this field to "MICR FROM CKID." Then set up the long description in the CKID common codes as described above.

2: This field determines what shows in description column of the Bank Information area on the payroll stub. When this field is blank, the check/EFT writer obtains the EFT bank transit number from the employee's deduction assignments.

When this field is set to "BANK INFO FROM HR," the bank name is looked up from the Bank Info table in HR by mapping the transit routing number from the employee's EFT deduction record. This eliminates the use of B# + Transit Number common codes.

3: This is reserved for programmer testing.

4: This is reserved for programmer testing.

5: This is reserved for programmer testing.