PYW2 - BOX12-xx

W-2 Form Options

There are two basic methods for filling in Box 12 and Box 14 on the W-2 forms.

For clients not needing the Box 12 or Box 14 overflow feature, separate value definitions may be specified for each Box item used.

For clients needing the overflow feature (for example, having potentially more than 4 Box 12 items), special common code settings are required.

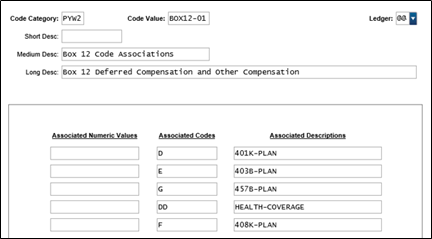

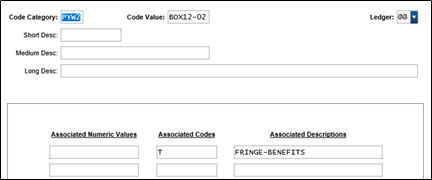

These common codes associate your value definitions with the required codes that are to be entered in Box 12 and 14. The common codes are set up as a range 01-99. The first one for each box would be PYW2/BOX12-01 and PYW2/BOX14-01. The last 2 digits may vary from 01 to 99 to create additional setups. Each common code may specify up to 5 Code and Value Definition pairs for the Box 12 and Box 14 items. Each site may set up as many as are needed.

For example, value definitions 401A, 401B, 401C, 401D, 401E and 401G all apply to Box 12. These would require 2 common codes (each common code can specify five entries). The first common code would hold 401A, 401B, 401C, 401D and 401E and the second would hold 401F and 401G. These value definitions are entered into the Associated Descriptions. The corresponding alpha reference code for each (A-H, J-N, P or Q as defined by the Social Security Administration) is entered into the corresponding associated code field for each. The Associated Code for Box 14 can be up to a 4-character description.

Code Category: PYW2

Code Value: BOX12-xx

Short Description: Not required.

Medium Description: Not required.

Long Description: Used to describe the common code.

Associated Numeric Values

1: Enter Max lines of Box 12, default is 4. Only for Common code PYW2/Box12-01.

2-5: Reserved for future use.

Associated Codes

1-5: Enter the SSA coded specified for Box 12 value.

Associated Descriptions

1-5: Enter the value definition name to be included in Box 12.

Note: This common code and the overflow feature are implemented by using the reserved word BOX12 in the Forms Definition page. The reserved word is entered in the Character String field and the row and column specified is for the top line for the Box 12 region.

You should use Box 12 common code settings if you will encounter overflow forms for Box 12.

The value definitions for Box 12 must be unique and used only in the common code setup. They cannot be used elsewhere in the W-2 setup.

Example