System Setup

New CDH Codes

To capture the new W-4 inputs for dependent amount, other income and other deductions, three new CDH codes are used in addition to the current FIT CDH. It is recommended that contribution codes are used since these CDHs do not deduct from actual employee pay, they are only used to adjust taxable wages and the final FIT calculation. in addition, a new pay base is used to accumulate FIT Wages and the new adjustment values. The default Pay Base is 21. This should have been reserved for use so if a district is using this pay base, they will need to select an open pay base and modify the updated FIT Calculation.

Dependent Amount (Step 3)

- Create a new contribution CDH (1xxx).

- Provide a descriptive Code and Title for the CDH (e.g., DEP AMT and DEPENDENT AMT).

- Misc Code 1 should be set to FITD. This will identify this CDH as the Dependent Amount in other areas such as Employee Online.

- Relate to Code 8 should be set to ADDT to accommodate the new Additional Taxes tab.

- Set the status field to A.

- Set the priority to run prior to your FIT CDH. Taxes are typically processed at priority 5000. If using a contribution CDH, you can set the priority the same as the FIT CDH as the contribution will run first.

- Optional: Set Switch 16 – Check Stub Flag to N. This will prevent this CDH from appearing on employee check stubs.

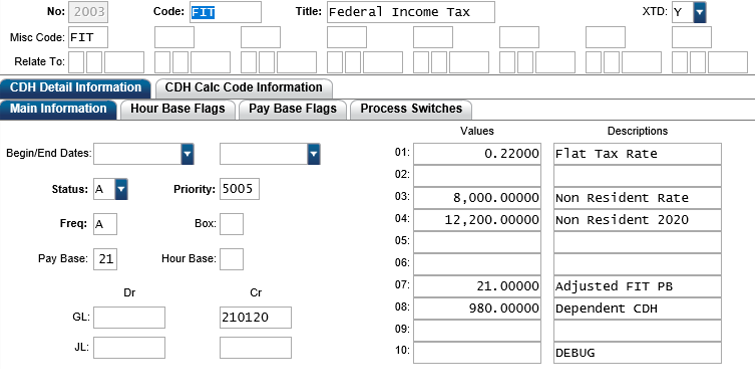

These are the only data entry points required for the Dependent Amount value. This CDH should be referenced on the FIT CDH Screen, Value 8 so the payroll calculation knows which CDH Code to load to determine final tax amounts. It should be referenced by the last three digits of the CDH code for loading purposes. For example, 1980 would be 980.

Other Income Amount (Step 4a)

- Create a new contribution CDH (1xxx).

- Provide a descriptive Code and Title for the CDH (e.g., OTH INC and OTHER INCOME).

- Misc Code 1 should be set to FITI. This will identify this CDH as the Other Income Amount in other areas such as Employee Online.

- Relate to Code 8 should be set to ADDT to accommodate the new Additional Taxes tab.

- Set the status field to A.

- Set the priority to run prior to your FIT CDH. Taxes are typically processed at priority 5000. If using a contribution CDH, you can set the priority the same as the FIT CDH as the contribution will run first.

- Place a + sign in PB 21; this CDH will add to Taxable Wages.

- Optional: Set Switch 16 – Check Stub Flag to N. This will prevent this CDH from appearing on employee check stubs.

Other Deductions Amount (Step 4b)

- Create a new contribution CDH (1xxx).

- Provide a descriptive Code and Title for the CDH (e.g., OTH DEDU and OTHER DEDUCTIONS).

- Misc Code 1 should be set to FITO. This will identify this CDH as the Other Income Amount in other areas such as Employee Online.

- Relate to Code 8 should be set to ADDT to accommodate the new Additional Tax tab.

- Set the status field to A.

- Set the priority to run prior to your FIT CDH. Taxes are typically processed at priority 5000. If using a contribution CDH, you can set the priority the same as the FIT CDH as the contribution will run first.

- Place a - sign in PB 21; this CDH will subtract from Taxable Wages.

- Optional: Set Switch 16 – Check Stub Flag to N. This will prevent this CDH from appearing on employee check stubs.

Existing CDH Codes Pay Base Flags

Existing CDH Codes that +/- the FIT Pay Base 3 need to be updated to +/- the new Adjusted FIT Pay Base 21 (or other pay base selected by the district). This preserves the true FIT Wages prior to any employee adjustments. These CDHs would include any taxable contributions, pre-tax deductions and hour codes that affect pay.

- Review your current CDH codes. If the CDH has a +/- in FIT Pay Base 3, the same +/- symbol should be placed in Pay Base 21 (or other pay base selected by the district).

FIT Calculation

The FIT Calculation was updated to allow for the new W-4 inputs and adjustments.

If a district has modified the FIT calculation, they will need to update their calc code. Due to the length of the current FIT calculation code, they may need to engage Services to help them re-work the logic to incorporate their customization.

- Copy the existing FIT calculation into Notepad and save a backup copy.

- Copy and paste the new FIT calculation into the FIT deduction calc code tab.

- Save the record.

- A new Non-Resident Alien rate has been added for 2020. This value will be stored in the FIT Deduction definition > Main Information Tab > Value 4. The previous rate will be stored in Value 3.

- Enter the PB Number for Adjusted FIT Wages in Value 7. The default should be Pay Base 21.

- Enter the last three digits of the Contribution Number used for the Dependent Amount in Value 8.

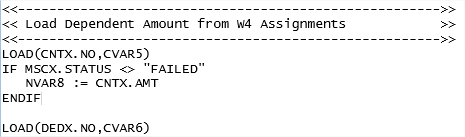

If you did not use a Contribution to capture this value, you will need to modify this portion of the calc code to load the deduction (CNTX would change to DEDX):

Sample FIT Setup

Below is a screenshot of a sample FIT setup. Note the differences for Non-Resident Aliens; clients will need to use a new code for Non-Resident Aliens who submit a new W-4.

Common Codes

New common codes were added to accommodate the multiple tax tables based on the Multiple Jobs check boxes.

Tax Tables

Tax table common codes for the multiple job option would follow the following naming convention:

FE + 2-digit tax year + Single Character Filing Status + 2 + 2-digit Record Number

E.g., FE20S201, FE20S202, FE20S203, FE20S204, FE20S205, FE20S206, FE20S207, FE20S208.

Standard Deduction Tables

Standard Deduction common codes for employees filing a new W-4 form will follow the following naming convention:

FE + 2-digit tax year + SD + Single Character Filing Status + 1

E.g., FE20SDH1, FE20SDM1, FE20SDS1.

These tables can be manually created for testing purposes by copying last year's tax tables.