Box 12 and 14 Overflow

BusinessPlus W-2 software supports automatic overflow handling for Box 12 and Box 14 across all supported W-2 formats, including PowerSchool approved formats:

2X2 Letter

2X2 Legal

1X4 Legal

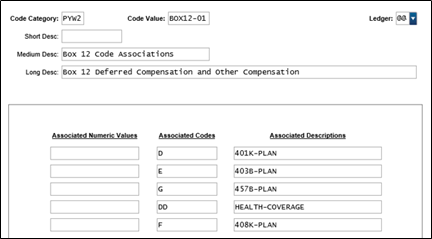

Common Code Configuration

To define Box 12 and Box 14 values, use the following common code structure:

Box 12: PYW2/BOX12-xx

Box 14: PYW2/BOX14-xx

(Where

xxranges from 01 to 99)

Each common code can hold up to five Code–Value Definition pairs. You can create multiple codes to accommodate more entries.

Example Setup for Box 12:

If you need to define seven Box 12 values (e.g., 401K, 403B, 457B, Health-Coverage, 408K, Fringe-Benefits), use two common codes:

PYW2/BOX12-01: 401K, 403B, 457B, Health-Coverage, 408KPYW2/BOX12-02: Fringe-Benefits

Each value definition (e.g., 401A) is paired with:

An Associated Code (e.g., D, E, G, etc.)

An Associated Description (e.g., 401K-PLAN, 403B-PLAN)

Refer to SSA guidelines for valid Box 12 codes (A–H, J–N, P, Q).

Box 14 works the same as box 12, using common code PYW2/BOX14-nn instead.

Line Spacing Adjustment:

For Box 12 vertical line spacing, modify PYFG/PY601C:

Set Associated Number Value 4 = 2.00000

2 is the default

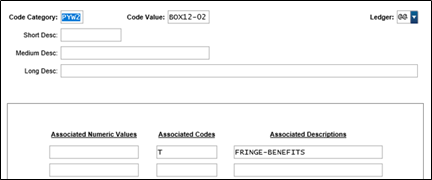

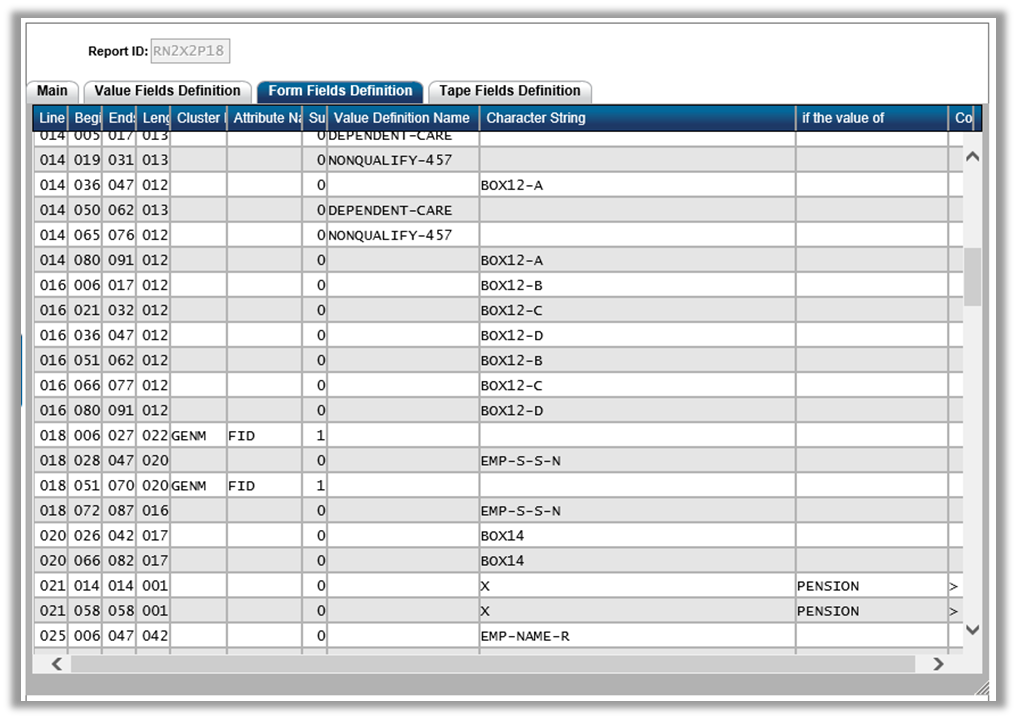

W-2 Definition Keywords

In the Form Field Definition tab of the PYW2UP page, use reserved keywords:

BOX12→ Automatically prints up to 4 vertical Box 12 entriesBOX14→ Automatically prints up to 4 vertical Box 14 entries

These keywords eliminate the need to define each Box 12/14 value manually in the W-2 definition file.

⚠️ Value definitions (e.g., 401K, 403B) must be unique and used only in the common code setup. They cannot be used elsewhere in the W-2 setup.

Adding Keyword to Definition File

To enable overflow printing:

Add

BOX12andBOX14to the first line where you want them printed.The system will print up to 4 lines vertically per form.

If more than 4 values exist, an additional W-2 page is automatically generated.

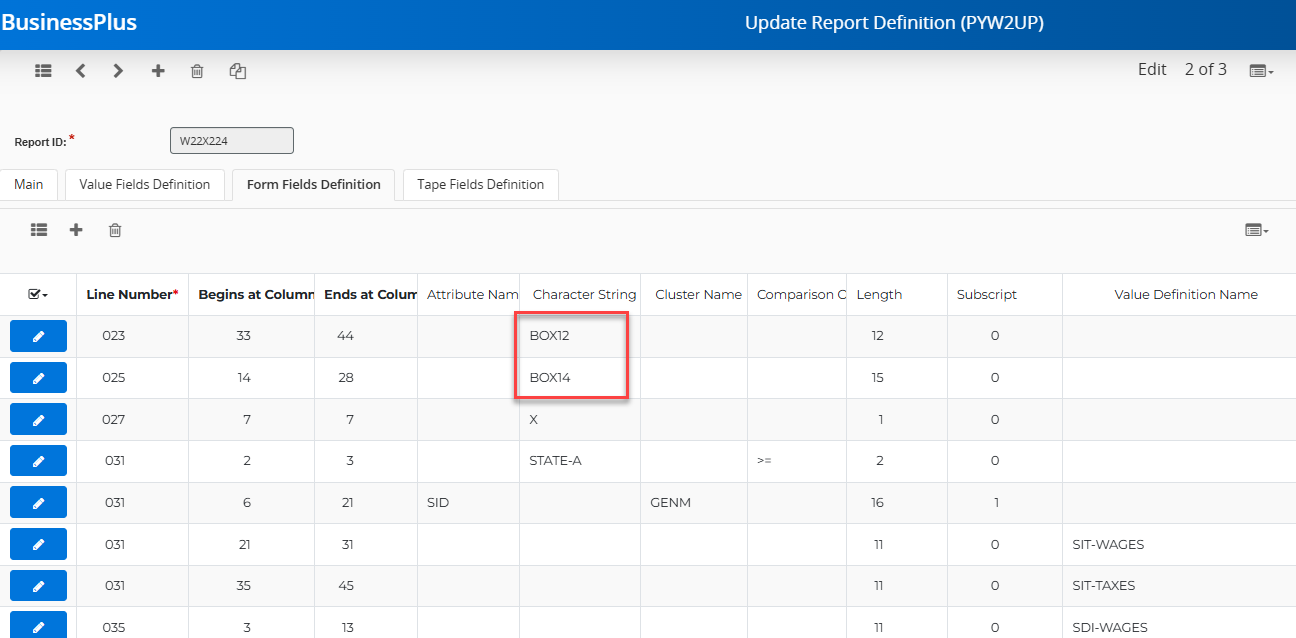

Automatic Overflow Behavior

Up to 4 Box 12 and 4 Box 14 items can be printed per W-2 form.

If more than 4 items exist, the system:

Automatically generates an additional W-2 page

Dynamically repositions items to fill space

Shifts remaining items upward if codes are unused

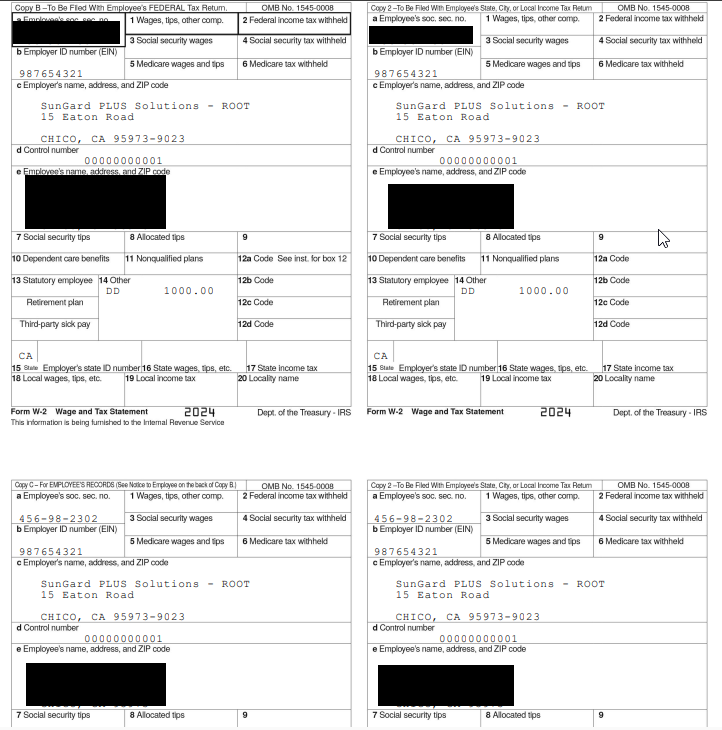

W2 Printed Overflow Example

Horizontal Overflow Support

Box 12

For horizontal W-2 layouts, use:

BOX12-A,BOX12-B,BOX12-C,BOX12-D(Each corresponds to a horizontal Box 12 field)

You can repeat these keywords as needed across lines and pages. Vertical overflow logic still applies—additional pages are generated if more than 4 Box 12 items exist.

The above entries refer to the following box 12 fields on the W-2 form:

Box 14

Box 14 is always printed vertically. Define it once at the top line of Box 14:

Use

BOX14keywordThe system repeats it vertically for all applicable entries

Overflow triggers a second W-2 page if needed

Summary of Key Setup Steps

Define common codes (

PYW2/BOX12-xx,PYW2/BOX14-xx)Assign value definitions with SSA codes and descriptions

Use keywords (

BOX12,BOX14, orBOX12-AtoBOX12-D) inPYW2UPAdjust line spacing via

PYFG/PY601Cif overflow occurs, if neededLet the system handle overflow—extra pages are auto-generated