BusinessPlus Changes

Schema

The 2019 Year-End Update includes new database table yr_addltax to accommodate storing the new W-4 form values needed for Payroll processing. All clients installing the update will have the schema change.

7i Pages

On the HR side, new screen tabs were introduced with the 2019 Year-End Update to hold the yr_addltax data. The tab reads Relate To 8 "ADDT" on the CDH Definition to determine which CDH codes to display.

Pre-19.12 Release

HR Mandatory Assignments (HRPYMD):

- The HR Mandatory Assignments page has new tab "Additional Taxes" (yr_addltax).

- New field "W4-2" was added to FIT section of the Primary Taxes (hr_mandded) tab to hold the "2 Job Tax" option. This setting updates PYUPEM, Switch 30; note that a user must make a change to the hr_mandded record in addition to the W-4 2 Flag in order to update the PY switch.

HR Pay Related Assignments (HREPPR):

- The Taxes tab HR Pay Related Assignments (HREPPR) page now has two sub-tabs: "Primary" (hr_mandded) and "Additional" (yr_addltax).

- New field "W4-2" was added to the FIT section of the Primary tab to hold the "2 Job Tax" option. This setting updates PYUPEM, Switch 30; note that a user must make a change to the hr_mandded record in addition to the W-4 2 Flag in order to update the PY switch.

Versions 19.12 and Up

For the cross-browser release (19.12) of BusinessPlus, screens HRPYMD and HREPPR were combined into the new CDH Assignments mask HRPYPR.

- The Additional tab holds yr_addltax information.

- New field "W4-2" was added to the FIT section of the Taxes (hr_mandded) tab.

PY Employee Master

PYUPEM Switch 30 is now designated to hold the 2 Jobs setting (Step 2) on the W-4. Payroll calculation uses this setting to determine which method to use to calculate taxes: a blank switch results in the old calculation method being used, while a Y or N setting will result in payroll using the new W-4 calculation code. The switch can be set to the following options:

- Y — Employee checked the 2 Jobs box on the new W-4 form

- N — Employee did not check the 2 Jobs box on the new W-4 form

[blank] — A blank switch indicates an employee has not yet filled out a new W-4 form

Employee Online

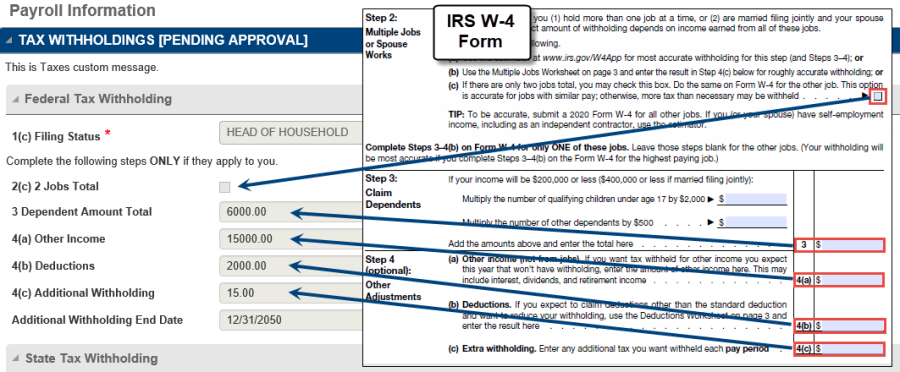

The Tax Withholdings card on the Employee Online (EO) Payroll information page was updated with the new W-4 options. Note that the Exemptions field was removed since it no longer applies.

Field labels on the updated Tax Withholdings card are named to match the steps listed on the W-4 form:

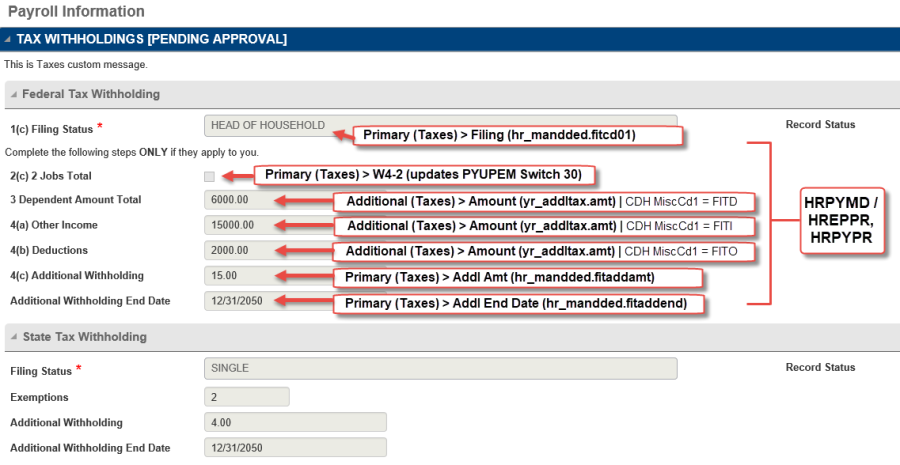

The EO fields relate to BusinessPlus masks (HRPYMD/HREPPR, HRPYPR) as follows:

Submitting the W-4 Form

After the EO user saves changes to any of the FIT CDH codes or the new additional tax CDH codes, the corresponding HR record (hr_mandded, yr_addltax) is set to WAIT status. The page becomes read-only; no additional changes can be made. After HR approves the changes, the record becomes available for edits again in EO.

Reference Table

W-4 Federal Tax Field | HRPYMD | HREPPR | HRPYPR | CDH | DB |

|---|---|---|---|---|---|

Filing Status (Step 1c) | Primary Taxes > Filing Status | Taxes > Primary > Filing FIT | Taxes > Federal Income Taxes > Filing Status | hr_mandded.fitcd01 | |

2 Jobs Total (Step 2) | Primary Taxes > W4-2 Available values: Y, N, blankUpdates: PYUPEM Switch 30 | Taxes > Primary > W4-2 Available values: Y, N, blankUpdates: PYUPEM Switch 30 | Taxes > Federal Income Taxes > W4-2 | ||

Claim Dependents Amt (Step 3) | Additional Taxes > Amount | Taxes > Additional > Amount | RelateTo8=ADDT | yr_addltax.amt | |

Other Income (Step 4a) | Additional Taxes > Amount | Taxes > Additional > Amount | RelateTo8=ADDT | yr_addltax.amt | |

Other Deductions (Step 4b) | Additional Taxes > Amount | Taxes > Additional > Amount | RelateTo8=ADDT | yr_addltax.amt | |

Extra Withholding(Step 4c) | Primary Taxes > Addl Amt (FIT) | Taxes > Additional > Add'l Amt (FIT) | hr_mandded. fitaddamt |