Accounts Receivable Posting Strategies

Overview

Accounts Receivable entries update the General Ledger when the Accounts Receivable set is posted (ARBTARDS). The GL postings are controlled, or limited, by posting codes on the transactions. The posting codes are assigned to the transaction based on the General Ledger Posting Preferences definition (GLUTSPPP). Posting preferences for AR are defined under subsystem AR and the ledger code assigned to the batch. If cash basis is used, no GLUTSPSI needs to be defined for subsystem AR. In these examples, we will be assuming accrual or modified accrual and using ledger GL.

The basic Accounts Receivable posting strategy will credit revenue (or the account number in the batch) and debit the AR control account.

We will look at how the posting code can be assigned by Posting Preferences or Finance Codes and how the control account can be hard-coded in GLUTSPSI or derived from the AR Division Code setup. It is best if the Preferences and Finance code setups are complimentary, because there is a re-derive utility that will change the posting code to reflect Posting Preferences setup only. This might change the posting code that was set by the Finance Code. Finance Code setup is usually defined to control AR batch creation from another process or system, for example, AP to AR, or JE to AR.

Base Setup

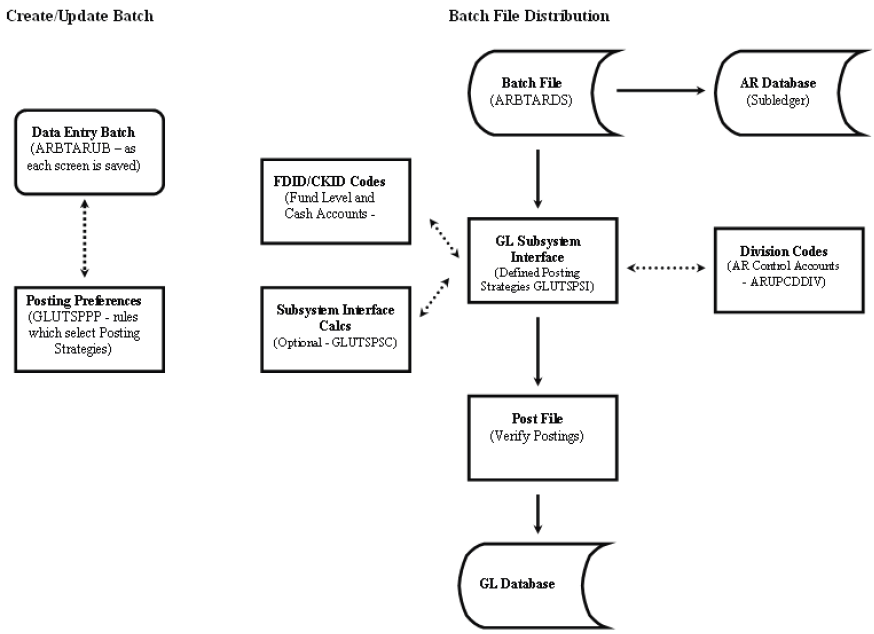

Before presenting the details of posting definitions, it may be helpful to outline the relationship of various coding structures to the data entry and batch file distribution process. The following diagram depicts these relationships for the Accounts Receivable subsystem. When the user is in the Create/Update Batch File function, a Posting Code is required. The Posting Preferences process derives the Posting Code based on user-defined logic for each subsystem. The Posting Code will be used during the batch posting process to direct the specific balancing entries. The following page depicts the relationship between the AR batch, posting utilities, and the databases.

Create/Update Batch - Batch File Distribution

Answers to certain questions will help determine how many posting scenarios will be needed and therefore how many posting codes will be required. Common questions are:

How many AR control accounts will be needed? Some examples might be General Accounts Receivable, Student Accounts Receivable, Employee Accounts Receivable, or Due from Other Governments.

Are the control account entries always/never recorded in the same fund as the revenue? If the answer is not "always" or "never", we will probably need to define special posting codes to differentiate where, and under what conditions, they should post.

What level of detail is needed in the General Ledger? Typically, the primary transactions are recorded in detail and the Control Account entries are recorded in summary. Occasionally, however, the primary transactions might be recorded in summary as well. If there is a mix of these, depending on Fund, Division, (etc.) posting codes will be needed to control these variations.