Cash Receipts Posting Strategies

Overview

Cash Receipt entries update the General Ledger when the CR batch is posted (ARBTCRDS). The GL postings are controlled, or limited, by posting codes on the transactions. The posting codes are assigned to the transaction based on the General Ledger Posting Preferences definition (GLUTSPPP). Posting Preferences for CR are defined under either subsystem CR or subsystem LC and the ledger code assigned to the batch. The system will derive the posting code from CR preferences if the Hit AR flag is Y and it will derive from LC preferences if the Hit AR flag is N"

The basic Cash Receipts posting strategy will credit revenue (or the account number in the batch) and debit cash, or it will credit the AR control account and debit cash. The system knows which credit to make based on the posting codes.

We will now look at how the posting code can be assigned by Posting Preferences, how the control account can be assigned by either hard-coding it in GLUTSPSI or using the AR Division Code setup.

Base Setup

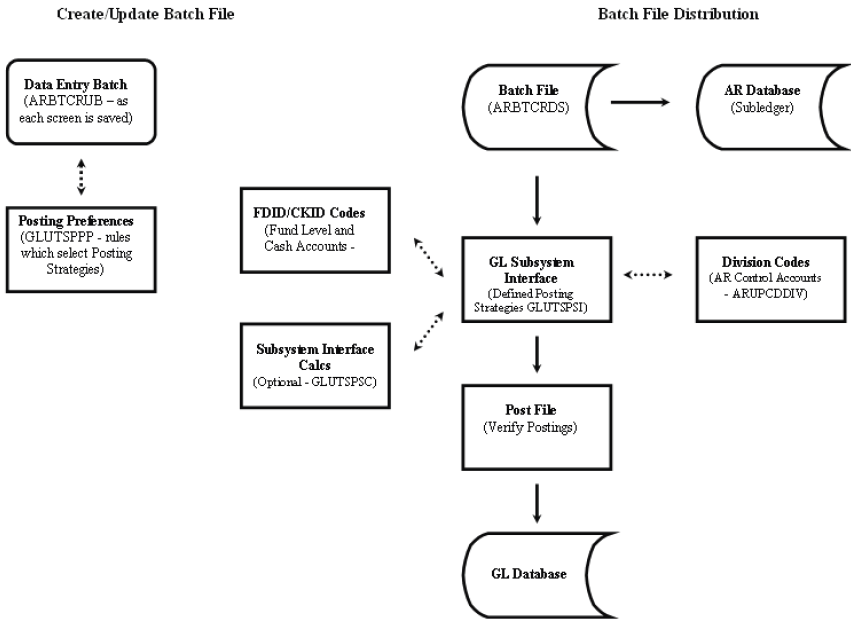

Before presenting the details of posting definitions, it may be helpful to outline the relationship of various coding structures to the data entry and batch file distribution process. The following diagram depicts these relationships for the Cash Receipts process. When the user is in the Create/Update Batch File function, a Posting Code is required. The Posting Preferences process derives the Posting Code based on user-defined logic for each subsystem. The Posting Code will be used during the batch posting process to direct the specific balancing entries. The following section depicts the relationship between the CR batch, posting utilities, and the databases.

Create/Update Batch File - Batch File Distribution

Posting scenarios for Cash Receipts will follow very closely with the Accounts Receivable scenarios. This is to ensure that the payments against invoices will properly clear the receivable in the General Ledger as well as clear the invoices in the Accounts Receivable database.