Accounts Payable Posting Strategies

Overview

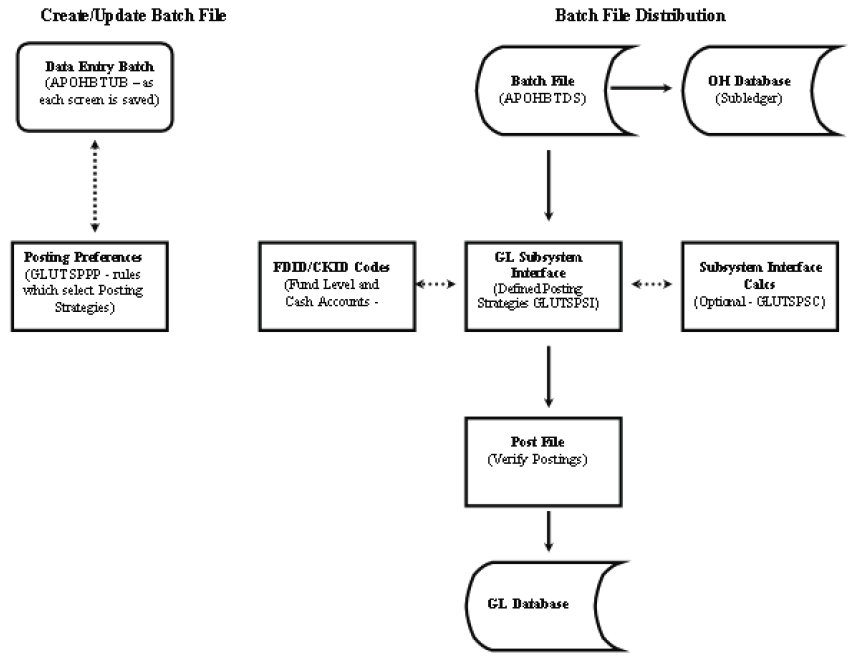

Accounts Payable entries update the General Ledger when the batch (OH, IP, or TR) is posted and/or paid. These postings are controlled or limited by posting codes on the transactions. The posting codes are assigned to the transaction based on the General Ledger Posting Preferences definitions (GLUTSPPP). Posting Preferences for all three subsystems are defined under subsystem AP (and, optionally, OH) and a specific ledger code. In these examples we will be using ledger GL.

Although there is only one Posting Preferences screen for the Accounts Payable processes, there are two General Ledger Subsystem Interface (GLUTSPSI) screens. They are GL / AP / DIST and GL / OH / DIST. Typically, the GL / AP / DIST is used for Immediate Pay A/P (IP) and Void, Typed & Reversed Checks (TR). The GL / OH / DIST is used only for Open Hold A/P (OH) batches. If the GL / OH / DIST is not set up, the system will use the GL / AP / DIST posting definitions. The most common reason for setting up the GL / OH / DIST definitions is to be able to post an accrual entry to an Accounts Payable liability account when the OH batch is distributed. When this definition is in place, the GL / AP / DIST will not have an accrual entry because the IP and TR batches are to post the expense and cash to the same date.

Create/Update Batch File - Batch File Distribution

The basic Accounts Payable posting strategy would debit the expense (or account number in the batch) and credit cash. Variations to this might result based on answers to the following questions:

Is Pooled cash being used? If it is, it will be necessary to set up interfund entries between the pool and the fund where expense is being posted.

Are AP accrual entries to be posted? If they are, it will be necessary to set up the credit to the accrual account at "P" date and the debit to the accrual account at "C" date. Also, if there is more than one accrual account, Posting Preferences will need to be able to isolate them, usually by Division Code.

Are Discounts being taken? If they are, it will be necessary to define cash and liability entries to post net rather than distribution amount.

Are Retention entries being added? If they are, it will be necessary to create posting logic to credit the Retention account.

Is USE TAX to be posted? If it is, posting logic will need to be defined to credit Use Tax Payable.

Are GL entries to be made at the time checks are cancelled? If there are, posting logic will need to be defined for "B" date entries.