Subsystem Posting Best Practices

Accounts Payable

Define the AP/DIST only. If both the OH/DIST and AP/DIST are defined, BusinessPlus uses the OH/DIST for Open Hold transactions only, and the AP/DIST for Immediate Pay (IP) and Void, Typed and Reversals (TR). Be careful using both strategies. For instance, if no handling is defined in AP/DIST for discount, contract retention or use tax, then any payments through Immediate Pay that involve these items will not generate the proper entries.

Most K-12 environments do not use a POOL CASH posting strategy. The Cash is posted at each FUND.

Use N Amount unless the customer specifically wants to track discount posting separately. Once Discount Posting is used, the discount will be lost if the invoice is paid late and the posting must be set up to pick up the Lost discount and include the Lost amount in the Check. N or Net will always net the discount with the invoice and will not be lost.

An Object code separate from regular accounts payable should be defined and used to record all use tax payable transactions. This aids in reconciliation by keeping the regular accounts payable account uncluttered.

For the same reason as above a separate liability Object code should be defined and used for Contract Retention.

Entries to the Contract Retention Payable account should be made in detail in order to record the PEIDs associated with the transactions. Clients typically need to provide a schedule of retention payables to their auditors at year-end and posting in detail will enable this report to be easily generated.

An Object Code should be set up for Year End Accruals that are entered via Journal entry outside of the AP system to keep the AP system pure to AP transactions.

If balance sheet account postings are to be at the Key level rather than the Fund level define this requirement in the FDID common code rather than attempting to define it in the GLUTSPSI. This will be discussed in more detail later.

Avoid hard coding the checking account Object code in the GLUTSPSI itself. Instead, use "CKOBJ" and define the Object code in the CKID common codes.

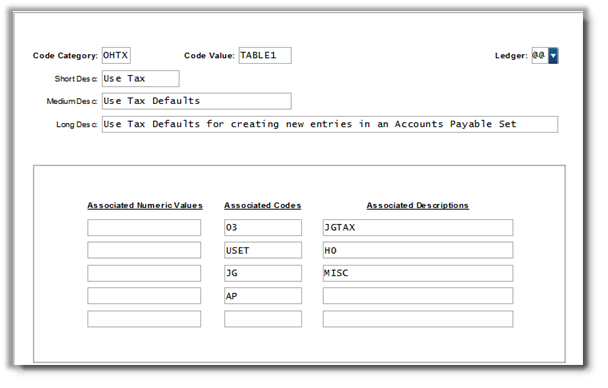

Use Tax

The use tax setup will create amounts payable to the Vendor in Associated Description 1 and place them in a H9 status until they are selected for payment. The amount of the invoice created for each transaction depends upon the Tax Rate charged from the original vendor compared to the State Tax Rate.

Example:

Associated Code 1 = Posting code to be used

Associated Code 2 = Division to be used

Associated Code 3 = Check to be used

Associated Code 4 = Vendor address to be used

Associated Description 1 = Vendor to be used for Tax Payments

Associated Description 2 = Hold Status for records created

If the code value of USE is used on the AP transaction, then the whole State Tax rate will be calculated as a related Tax Invoice. When it is time to cut the State Check then select for pay on H9 in conjunction with the Vendor Code.

Retention

The retention transaction that is created by BusinessPlus is a negative debit and therefore the treatment in the GLUTSPSI needs to be a debit at posting time. When the contract retention is paid out then the transaction for the payment is manually initiated with an invoice made payable to the vendor and the liability account will be debited correctly.

POAS/RTLIMIT common code

Associated Description 1 = Post code

Associated Description 2 = Object code

Associated Description 3 = OHMC – Open hold miscellaneous code for Retention items

Associated Description 5 = FDKEY if the liability should direct to the FDKEY

ON the Contract PO the POAS/RTLIMIT must be used in conjunction with either the RTPERCENT, RTDOLLAR and/or RTMAX:

RTPERCENT is used to put the percentage for the retention

RTMAX is used to put the Maximum amount to withhold

RTDOLLAR is used to put a Maximum dollar amount to withhold

An OHMC code of NORT can be used to stop retention on a particular invoice.

RTLIMIT must always be placed on item number one. An amount is required in the value field. If using RTPERCNT, it is recommended that this amount be larger than the estimated retainage (use the total amount of the item), simply because change orders increasing the total contract amount are very common.

Accounts Receivable

Define the receivable Object code(s) to be used in the Accounts Receivable Division Code definitions (ARUPCD) and refer to them in the GLUTSPSI by using DVOBJ. Hard-coding the Object in GLUTSPSI may not stand the test of time and may eventually lead to incorrect postings.

Avoid using DVKEY in the GLUTSPSI, Use FDKEY.

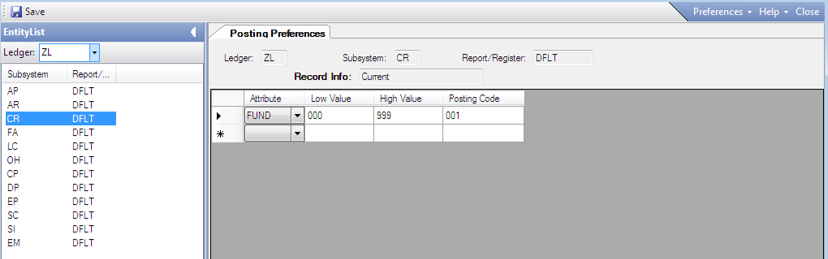

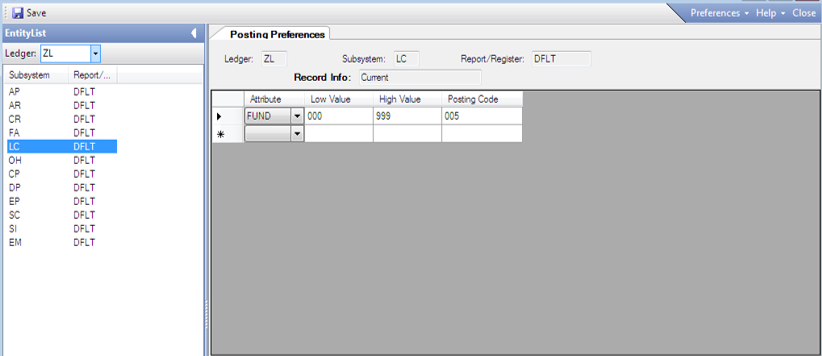

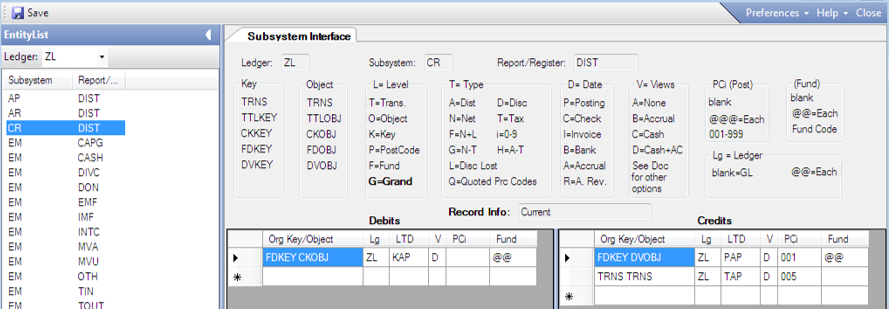

Cash Receipts

GLUTSPPP and GLUTSPSI

CR posting preference (HIT AR = Y)

Lonesome "DIRECT" Cash – ICR – posting preference (HIT AR = N)

CR Distribution

This will post the Cash to the Fund Level Key from the FDID Associated Code 1 and the Object from the CKID common Code Associated Code 2. The Credit will be to the FDID associated Key 1 and the Object code from the AR division code for CR transactions and to the Detail FQA or Key and Object from the Direct Cash items.

Payroll Posting

Separate payroll liability Object codes should be established for each contribution and deduction. Such accounts are difficult to keep reconciled even under the best of circumstances and maintaining such liabilities separate from each other will aid in this process.

GLUTSPSI

The payroll subsystem interface is accomplished with three separate definitions:

PY/EREG: Earnings – Regular, overtime, vacation, sick, compensatory time off and optionally other employer provided direct contributions.

PY/DREG: Deductions – Individual employee payroll deductions.

PY/CREG: Contributions – Employer provided fringe benefits

Total for Each | Level (L) | Transaction Description |

|---|---|---|

Individual Employee | T | Employee Name |

Each different Object | O | Object Description |

Each different Org Key | K | Org Key Title |

Each different CDH | P | CDH Description |

Fund Administration | F | Fund Description |

Grand Total | G | Grand Total "Register Name" |

Type of Posting | Type (T) | Transaction Description |

|---|---|---|

Regular Amount | 1 | REG |

Overtime Pay | 2 | O/T |

Vacation Pay | 3 | VAC |

Holiday Pay | 4 | HOL |

Sick Pay | 5 | SICK |

Compensatory Time Off Pay | 6 | CTO |

Gross Pay | 7 | GRS |

Net Pay | 8 | NET |

Gross Pay + Contributions | 9 | TEX |

Gross Pay + Direct Contributions | 0 | TOT |

Type 1 is used by the EREG, DREG and CREG. All others are used only with the EREG. Most commonly used are BOLD.

Posting Mappings

Occasionally it is desirable, for example, to map the Contributions based upon the Hour Code or employee type or bargaining unit. This is done by creating a mapping in GLUTSPPM and then creating common codes (GLxx/PMAPyyy) to override the Object code.