Payroll Overview

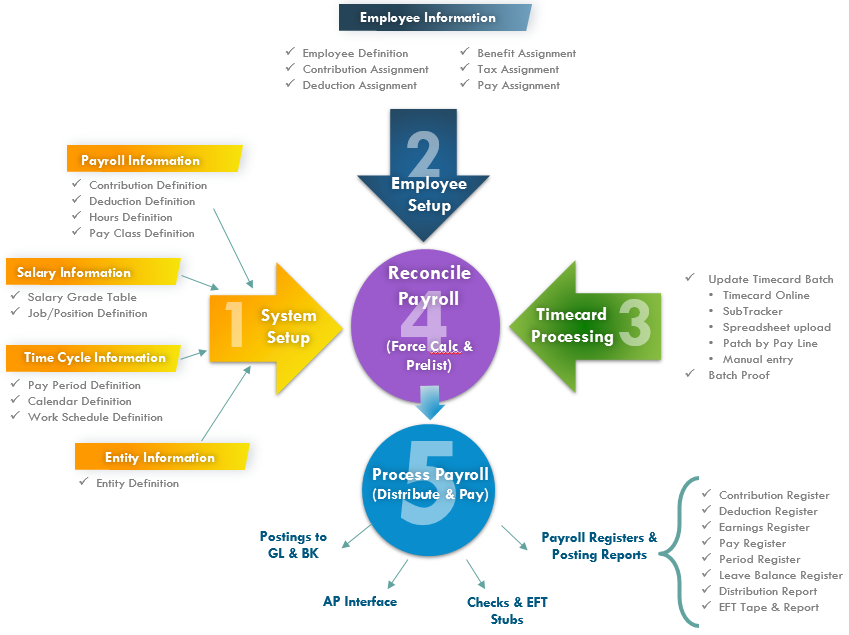

Payroll (PY) is a table-driven system. These tables allow the software (programs) to compute and post payroll in a manner that reflects each organization's changing needs. Two main types of information exist in Payroll: System Setup Information and Employee-Specific Information. The relationship between these types is diagrammed below.

Processing Steps

Running a payroll consists of five main processing steps:

Verify system setup information, such as pay period definitions.

Verify employee-specific information, such as contribution and deduction assignments.

Calculate and error check payroll.

Distribute and Pay payroll.

Refer to the Payroll Checklist for a step-by-step list.

Timecard Batches and Patching Hours

A timecard batch is typically processed before running payroll. Only exception-type hours, such as vacation used, need to be input into this batch, as the system may be configured to take advantage of a feature called "patching." When enabled, this feature "patches" hours for salaried employees based on any exceptions entered in the timecard batch. For example, if an employee had 16 hours of vacation and 24 hours of regular time for a 40-hour work week, the user would enter the 16 vacation hours because these are the exception-type hours. The remaining 24 hours would be "patched" to that employee's records when payroll is calculated. After entering the timecard information and reviewing the entries, the system distributes the information to the Employee Payroll History in the PY database.

Pay Bases, Hour Bases and Payroll Calculations

The Payroll calculation process (PYPAFC) for a pay period considers an employee's timecard entries, any defined "patch" hours, contribution formulas, deduction formulas, any automatic hours (e.g., vacation accrual), and any assignment overrides.

Most calculations are done by manipulating Pay Bases and/or Hour Bases. Different types of Pay Bases and Hour Bases are stored in the system for each employee based on the defined entity parameters. These bases are used for various reports.

There are 32 Pay Bases, including: Total, Gross, FIT, SIT, CIT, FICA, Retirement, Net, FLSA, Worker's Comp, Medicare, SUI, SDI, Patch, and Flat Tax. Entity-specific Pay Bases may be defined as needed.

There are 32 Hour Bases including: Total, Regular, Overtime, FLSA, Vacation Leave, Sick Leave, Floating Holiday, Parental Leave, Military Leave, Jury Duty, Bereavement Leave, and Comp Time. Entity-specific Hour Bases may be defined as needed. These bases are typically used to track what has taken place (i.e., either hours worked/taken, or dollars paid/earned). The bases may also be used to hold running balances (e.g., FIT, Taxable Wages, Vacation Balance, Sick Balance, etc.). Net pay, for each employee, at the time that paychecks are printed is the final amount in the Net Pay Base for the payroll period being run.

Employee Prelist

Once payroll has been calculated, the user will run an Employee Prelist (PYREEL). This report provides a listing of the results of the payroll calculation and should be thoroughly reviewed before payroll checks are printed.

Trial Payroll

The user may also run a trial payroll process (PYTPDP) that will print "checks" on plain paper (versus check stock) for verification purposes. During the Trial Payroll, all reports, including the posting reports, are printed. It is advisable to do this before running the actual pay as no database changes take place during the trial payroll process. If any errors have been discovered, the user can make necessary corrections, recalculate, and run a new Employee Prelist (and optionally, a new Trial Payroll) to verify.

Distribute and Pay

After the Employee Prelist and the optional Trial Payroll are correct, the Distribute and Pay function of payroll (PYPADP) is run. This process recalculates payroll, prints a new Employee Prelist, prints pay checks, distributes check information to the Bank Database, and distributes posting transactions to the General Ledger database. Several reports are printed at this time, including: Check Register, Period Register, Contribution Register, Deduction Register, Earnings Register, Pay Register, Leave Balance Register, as well as several posting reports. This information is helpful for the reconciliation process.

Payroll Reporting

Reporting is an important function within Payroll. The system supports special reporting needs: W-2s, 941s, PERS, STRS, etc. Several different file listing formats that detail the information stored in the database are supported. A generalized Report Writer is also included. For a complete list of reports, the user may select PYRE (i.e., Payroll Report) at the main menu and review the available options. Many of these reports require special setup in the Payroll definitions. Additionally, specialized user-defined reports may be obtained through the Click, Drag, and Drill (CDD) Report Writer as well as Cognos reporting software.